Pretty ambitious title right?

I would have thought the same 5 years ago before I cracked the code to scale a multi 7 figure lifestyle business.

Currently I am writing this as I sit by the beach in far North Queensland, 3 months into my year travelling around Australia while my team runs my business for me (and also having three back to back record months in my absence!)

This has only been possible by implementing the exact strategies I am going to share with you in this article.

The biggest problems getting in the way of more business owners like you creating financial freedom come down to three things;

- You don’t know what financial freedom actually looks like by your own definition

- You haven’t linked your activity in your business to the profit required for you to fuel your financial freedom ambitions

- Your business is built around you being the hero of the story which in turn means you have no freedom, no flexibility and struggle to escape your golden handcuffs

Trust me, I used to be there too and it sucks.

The way business owners learn to scale a business is by osmosis. We observe the way others grow their business; typically through 60-80 hour weeks, paying themselves last, working themselves to death for the hope of one day selling their business and sailing off into the sunset when they are old and grey to sip rum out of a coconut on a tropical beach, only then reaping the rewards of all of their hard work.

I don’t know about you, but that sounds terrible.

I watched my father follow the same path for decades, working 16 hour days in his variety of business ventures hoping he would be able to squirrel away enough money to retire at 65 and live the dream.

Unfortunately, at 66 he was diagnosed with late stage pancreatic cancer and died shortly thereafter.

This is the harsh reality of life.

So how do we do this the right way?

- Get clear on your definition of financial freedom

This is the biggest issue that plagues most business owners we work with. They have an abstract idea of what financial freedom means, but it is more of a dream than a goal.

If you want any chance of using your business as a vehicle to manufacture financial freedom, you need to get crystal clear on what financial freedom means to you and your family.

Do you ever want to retire completely?

If not, how much would you expect to work and how much would you earn?

How much does your ideal lifestyle cost in today’s dollars?

When do you want to achieve this goal?By answering these questions, we can work out your F3 (Financial Freedom Figure).

For example, let’s say you never plan to fully retire but expect you can consult and make $30,000 a year after tax. Then your dream lifestyle considering the home is paid off, the cost of living, lifestyle expenses and holidays will require you $150,000 a year. That means our wealth only needs to provide us with $120,000 a year.

We now have a clear north star and we can work out how to make it happen.

The simplest financial freedom formula you will ever need is as follows;

F3 / 5 x 100 = net worth required

Eg – $120,000 / 5 x 100 = $2,400,000

This is the total wealth you need to achieve your financial freedom goal. This might seem a little scary but we will talk about how we get there next.

- Understand the personal levers

The challenge for most wealth accumulators chasing financial freedom is that they are in the passenger seat of their wealth journey.

They are relying on market returns, financial advisors, accountants, and other professionals to achieve their goals. By doing this, they are abdicating financial responsibility into the hands of others, taking a leap of faith in hope they achieve their goals.

After working in this space for over 14 years, I now realize that this fails for more people than it helps successfully create financial freedom, and for those it helps, this is more based on luck than any scientific formula.

You as an entrepreneur need to take control of the financial reigns, sit in the drivers seat and be the master of your own financial destiny. Any other way is going to result in you being unable to control the outcome you desire.

So how do we achieve this?

We firstly need to understand the 11 levers available to us across life and business. Let’s start with the personal levers.

When it comes to wealth creation, there are four levers you can pull when it comes to creating wealth;

- Current wealth – how much do you have in investment assets currently

- Contribution – how much can you add to your portfolio

- Risk – how much risk you can afford to take, and in turn the expected return

- Time – how long are you prepared to wait to achieve your goal

By understanding these levers, we can have complete influence over the outcome we desire.

For example, if we have $400,000 now, want to achieve a total wealth of $2,400,000, expect an 8% average return and can afford to contribute $1,000 a month, it will take us 19 years and 4 month to achieve this goal.

But what if we want to achieve this in 10 years? What levers should we pull?Well, we could take more risk and chase a 10% return. But as this is an external variable, this isn’t guaranteed. If we achieved this, it would reduce the time taken by 3 years.

What if we kept an 8% return but increased our monthly contribution to $8,300? We will get there in exactly 10 years.

You’re probably thinking – well, Jackson that is a lot of money!

This is where we review your business levers.

- The business levers

There are 7 business levers we can pull to maximize our profit and cash flow. I will go into this in more detail in a separate blog, but for now we need to know that the 7 levers are;

Volume – the number of clients you take on

Price – the price you charge for your product or service

Cost of Sales – the variable expenses to deliver your product or service

Operating Expenses – the fixed expenses to run your business

Accounts Receivable – the time it takes you to get paid from your clients

Work in Progress – the work you are currently delivering on

Accounts Payable – the time it takes you to pay your billsBy understanding these levers and how they can impact your profit and cash-flow, we can identify the simplest path to achieving the level of surplus required to fuel your wealth.

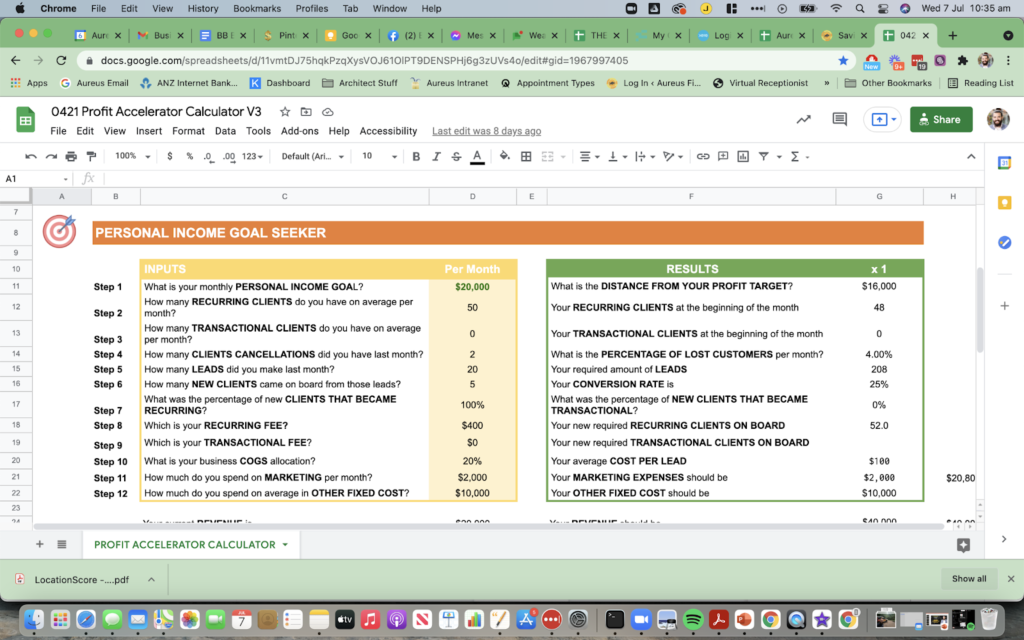

Good news is, we have developed a simple calculator that allows you to reverse engineer your goals into your 7 levers and work out the best path to smashing your goals.

If you want a copy of this Profit Accelerator Calculator, you can grab it along with free copies of my best selling book in our free Facebook Group. Link is bit.ly/YLBGroup

Remember, financial freedom is all about getting you into the driver’s seat. Let’s make all of your hard work pay off so you can live the dream you deserve.

Written by Jackson Millan

Jackson Millan, also known as The Wealth Mentor is an international best selling author and award-winning wealth coach. Jackson has spent the last 12 years dominating the wealth and business strategy space having worked with over 1,000 clients to help them build over $1.2b in combined wealth.

Want to learn more about growing your business and creating financial freedom? Join the world’s #1 business program, Business Blueprint. By joining our community, you can get access to Jackson and other world class mentors.